What is Drug Rehab? A Comprehensive Guide to Addiction Treatment

Discover drug rehab options, therapies, and costs. Understand addiction, find quality programs, and begin your path to lasting recovery.

Humana Insurance: Coverage for Addiction Treatment (2026) provides essential support for individuals seeking help with substance use disorders. Here’s what you need to know:

Quick Answer: Does Humana Cover Addiction Treatment?

If you’re struggling with addiction, understanding your insurance coverage can feel overwhelming—especially when you’re already facing the weight of substance use challenges. The good news is that substance use disorder (SUD) treatment is now considered an essential health benefit under the Affordable Care Act, meaning Humana plans are required to cover these services at parity with medical and surgical care.

Humana serves over 16 million people across the United States, including more than 8 million Medicare beneficiaries. Their coverage for addiction treatment ranges from medical detox and inpatient rehabilitation to outpatient counseling and medication-assisted treatment. However, the specifics of what’s covered—and how much you’ll pay—depend heavily on your individual plan type, whether facilities are in-network, and if services are deemed medically necessary.

Finding the right treatment shouldn’t be a barrier to your recovery. That’s why understanding your Humana benefits before you begin treatment is crucial. Many individuals find too late that their chosen facility is out-of-network, leading to unexpected bills that can derail their recovery journey. Whether you have a Medicare Advantage plan with $0 copays for mental health services, an employer-sponsored plan with varying deductibles, or a Medicaid managed care plan, knowing your coverage details empowers you to make informed decisions.

At Sober Steps, we specialize in helping individuals steer the complex landscape of insurance coverage for addiction treatment, including understanding the nuances of Humana Insurance: Coverage for Addiction Treatment (2026) across all plan types. Our team has guided thousands of people through the recovery process, ensuring they access the care they need without financial surprise. For immediate, confidential assistance verifying your Humana benefits and finding treatment options, call us at (844) 491-5566—our compassionate specialists are available 24/7 to answer your questions and help you take that crucial first step toward recovery.

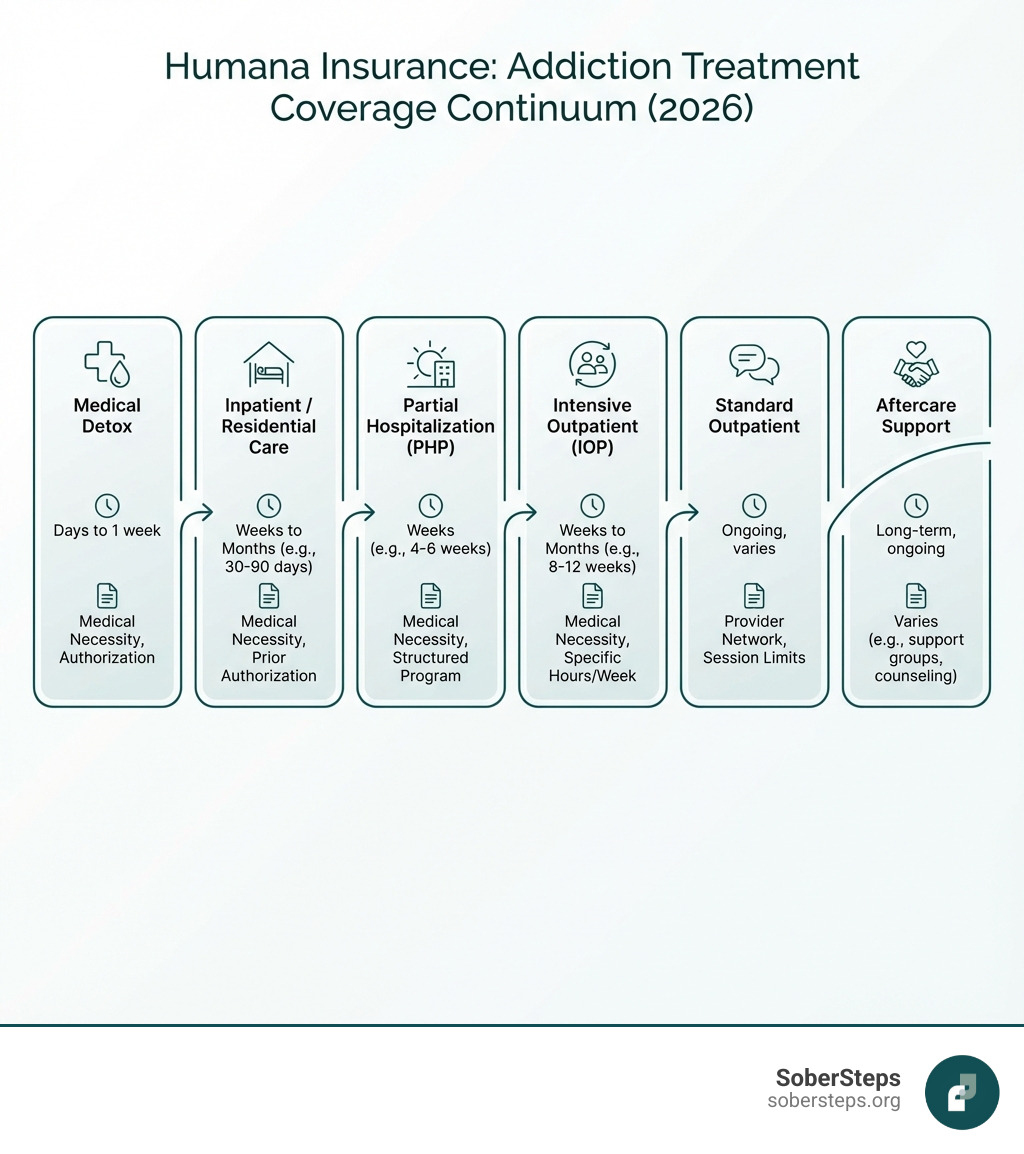

When we talk about Humana Insurance: Coverage for Addiction Treatment (2026), it’s important to understand the breadth of services that may be covered. Thanks to the Affordable Care Act (ACA), most Humana plans are mandated to cover substance abuse treatment. This means a wide range of services designed to help you or your loved one achieve lasting recovery are generally accessible. The key phrase here is “medically necessary” – Humana, like other insurers, will cover services that a healthcare professional deems essential for your treatment and recovery.

Humana’s coverage typically extends to various levels of care, from the initial stages of detox to ongoing therapy and support. They understand that addiction is a complex disease requiring a comprehensive approach. This often includes dual diagnosis treatment, which addresses co-occurring mental health disorders alongside substance use disorders. It’s common for individuals struggling with addiction to also experience conditions like depression, anxiety, or PTSD, and effective treatment often means addressing both simultaneously. Humana Behavioral Health plays a significant role here, coordinating these services to ensure integrated care.

It’s worth noting that while Humana covers a range of treatments, they generally require facilities to be in-network. This is a common practice among insurers to manage costs and ensure quality of care within their established network of providers. If you’re unsure about what specific services your plan covers or need help finding an in-network provider, don’t hesitate to call (844) 491-5566 for a confidential assessment.

For many, the journey to sobriety begins with inpatient or residential treatment. These services offer a highly structured environment with 24/7 medical supervision, which is crucial for individuals with severe substance use disorders (SUDs).

These programs are particularly beneficial for those who need a high level of support and care to begin their recovery journey.

Once a patient has completed inpatient care, or if their addiction is less severe, outpatient programs offer a flexible yet effective pathway to recovery. These programs allow individuals to live at home and continue with work, school, or family responsibilities while attending treatment sessions.

Humana’s coverage for outpatient addiction treatment typically includes:

Outpatient programs are vital for integrating recovery into daily life, providing ongoing support and coping mechanisms.

Medication-Assisted Treatment (MAT) is a scientifically proven approach that combines FDA-approved medications with counseling and behavioral therapies. It’s particularly effective for opioid use disorder (OUD) and alcohol use disorder (AUD), helping to reduce cravings, manage withdrawal symptoms, and prevent relapse.

Humana recognizes the effectiveness of MAT and generally covers these services. This includes the medications themselves, as well as the associated therapy and counseling. For example, Humana covers the costs of prescription medications for addiction, according to policy specifics for generic/brand name and co-pays, including medications for detox and maintenance. The 2026 Humana Medicare Advantage plans, for instance, nearly all include $0 copays on Tier 1 prescriptions, which can be very beneficial for MAT medications.

MAT is not simply substituting one drug for another; it’s a holistic approach that significantly improves treatment outcomes. To learn more about the effectiveness of addiction treatment, including MAT, you can refer to resources like the National Institute on Drug Abuse: How Effective Is Drug Addiction Treatment?.

Humana offers a variety of health insurance plans, and the specifics of your addiction treatment coverage will vary significantly depending on the type of plan you have. Think of it like choosing a car – while they all get you from point A to point B, a sedan’s features and costs will differ greatly from an SUV’s. Similarly, Humana’s coverage for addiction treatment in 2026 can look quite different across Medicare Advantage, employer-sponsored, and Medicaid plans.

We always recommend reviewing your specific policy documents and Summary of Benefits. These documents are your insurance plan’s “owner’s manual,” detailing what’s covered, your responsibilities, and any limitations. Verifying your benefits before seeking treatment is not just a good idea; it’s crucial to avoid unexpected costs and ensure you receive the care you need. If you’re feeling lost in the paperwork, remember we’re here to help. Call (844) 491-5566 to understand your specific plan and what it means for your addiction treatment coverage.

Humana is a prominent Medicare-focused health insurance provider, serving over 8.2 million Medicare members as of June 30, 2025, with approximately 5.8 million enrolled in Medicare Advantage (MA) plans. For 2026, Humana will have Medicare Advantage plan offerings in 46 states and Washington, D.C., covering 85% of U.S. counties. This means a lot of seniors and individuals with disabilities rely on Humana for their healthcare needs, including addiction treatment.

Medicare Advantage plans (also known as Part C) combine your Original Medicare benefits (Parts A and B) with additional coverage, often including prescription drugs (Part D), dental, vision, and hearing. Humana offers various types of MA plans:

For 2026, many Humana Medicare Advantage plans are designed with senior-focused care in mind, acknowledging the unique challenges older adults face with substance use. For example, the Humana USAA Honor Giveback plan for 2026 features a $0 copay for in-network mental health services, including therapy and specialist visits, both virtually and in-person. This is a significant benefit for veterans and other beneficiaries who need behavioral health support. Additionally, nearly all Humana non-special needs Medicare Advantage plans for 2026 include $0 in-network copays for PCP visits and $0 copays on Tier 1 prescriptions.

To explore Humana Medicare plans available in your area and understand their specific addiction treatment benefits, visit Find Humana Medicare plans.

Beyond Medicare, many individuals in the United States receive their health insurance through an employer or purchase it directly through the Affordable Care Act (ACA) marketplace. Humana offers a range of these plans, and their coverage for addiction treatment in 2026, as mandated by the ACA, will include essential health benefits like mental health and substance use disorder services.

These plans often come in different tiers, each with a unique balance of premiums and out-of-pocket costs:

It’s crucial to understand your plan’s deductible (the amount you pay before your insurance starts to cover costs) and copays (a fixed amount you pay for a covered service). While most Humana plans will cover substance abuse treatment, the out-of-pocket expenses can vary significantly depending on your plan tier. To understand the general requirements for mental health and substance abuse coverage under the ACA, you can visit Mental health and substance abuse coverage.

For individuals with lower incomes who qualify, Humana also offers Medicaid managed care plans in specific states, including Illinois, Kentucky, and Florida. Medicaid is a joint federal and state program that provides health coverage, and Humana’s role is to manage these benefits for eligible members.

Humana Medicaid plans typically cover a range of health services, including preventive care, doctor visits, and, importantly for our discussion, addiction treatment. The specifics of what’s covered under Humana Medicaid for addiction treatment in 2026 will be state-specific, as each state administers its Medicaid program differently. These plans are designed to provide essential care to those who might otherwise struggle to afford it, ensuring access to necessary addiction treatment services within the program’s guidelines. Eligibility requirements are strict and based on income and family size, so it’s important to check the specific criteria for your state.

Understanding your Humana Insurance: Coverage for Addiction Treatment (2026) is only half the battle; navigating the associated costs and verifying your specific benefits is the other. It can feel like deciphering ancient hieroglyphs, but with a little guidance, it becomes much clearer. We’re talking about deductibles, copayments, coinsurance, and the ever-present question of in-network versus out-of-network providers. Plus, many services require pre-authorization, a step that, if missed, can lead to unwelcome financial surprises.

We know it’s a lot to take in, especially when you’re already facing a difficult situation. That’s why we encourage you to reach out. Call (844) 491-5566 for a free, confidential benefits check. Our specialists can help you cut through the confusion and get clear answers about your Humana plan.

Even with insurance, you’ll likely have some out-of-pocket costs. These are the expenses you pay directly for your healthcare. It’s like paying for a fancy coffee – the insurance covers the bulk, but you still chip in a bit.

Here’s a quick rundown of common out-of-pocket expenses you might encounter with Humana for addiction treatment:

The exact amounts for these will vary significantly based on your specific Humana plan (e.g., Bronze, Silver, Gold, Platinum plans each have different cost-sharing structures) and whether the treatment facility is in-network. Choosing an in-network provider almost always results in lower out-of-pocket expenses.

Verifying your Humana benefits for addiction treatment is a critical step. It’s like checking the weather before a big trip – you don’t want to be caught off guard! Here are the best ways to get accurate information about your Humana Insurance: Coverage for Addiction Treatment (2026):

Even with the best insurance, there might be costs not fully covered by your Humana plan, or you might have a high deductible. Don’t let this deter you from seeking help. There are several alternative methods to help manage these expenses:

Your health and recovery are paramount. If you need assistance exploring these options, our team can provide guidance and support.

We often hear similar questions from individuals and families trying to understand their Humana Insurance: Coverage for Addiction Treatment (2026). Let’s tackle some of the most common ones.

This is a common question, and the simple answer is: generally, no, not directly for the “luxury” aspects. Humana, like most insurance providers, focuses on covering medically necessary treatment. While some high-end facilities may offer excellent care, the amenities that make them “luxury” (think private chefs, spa services, or equestrian therapy) are typically not covered by insurance.

Humana will pay for the “medicine” of treatment, not the “vacation” aspects.

Humana Behavioral Health is a crucial component of Humana’s commitment to comprehensive care. It’s a subsidiary of Humana dedicated to managing mental health and substance use disorder (SUD) benefits. Think of them as the specialized department within Humana that focuses specifically on your mental well-being and addiction recovery.

Their role includes:

To learn more about the resources and support offered by Humana Behavioral Health, you can visit their dedicated page: Learn more about Humana Behavioral Health.

Yes, in many cases, pre-authorization (also known as prior authorization) is required for addiction treatment services under Humana plans. This is a common practice across the insurance industry and is not unique to Humana. Think of it as getting a “permission slip” from your insurance company before you start a significant medical service.

To confirm your plan’s specific requirements for Humana Insurance: Coverage for Addiction Treatment (2026), including any pre-authorization needs, call (844) 491-5566. We can help you understand these crucial steps.

Taking the first step toward recovery is incredibly brave, and we believe that everyone deserves access to quality addiction treatment. Understanding your Humana Insurance: Coverage for Addiction Treatment (2026) can feel like a daunting task, but it shouldn’t be a barrier to getting the help you need. Recovery is not just possible; it’s a reality for millions of people, and it can be for you too.

At SoberSteps, we are committed to providing confidential and anonymous help for individuals struggling with mental health and substance use disorders. Your privacy is our priority, and our goal is to empower you with the information and resources necessary to make informed decisions about your treatment journey. We know that navigating insurance can be complex, and that’s precisely why we’re here to simplify the process.

Don’t wait to seek help. Every day is an opportunity for a new beginning. If you’re ready to explore your treatment options and understand how your Humana insurance can support your recovery, we encourage you to reach out. For immediate, confidential assistance with verifying your insurance benefits and finding a treatment provider that meets your needs, please visit our dedicated page: Find confidential help with your insurance.

Alternatively, you can call our 24/7 helpline at (844) 491-5566 for a no-obligation consultation. Our compassionate and experienced specialists are ready to answer your questions and guide you toward a healthier, sober future. Your journey to recovery starts here.

Discover drug rehab options, therapies, and costs. Understand addiction, find quality programs, and begin your path to lasting recovery.

Guide to rehab centers for alcohol abuse. Understand treatment, costs & life after. Start your recovery journey with SoberSteps.

Navigate affordable mental health care. Discover free, low-cost, and sliding scale therapy options for accessible support now.

For anyone seeking help for addiction for themselves or a loved one calls to Sober Steps are completely confidential and available 24/7.

Please note: any treatment center listed on our site that receives calls is a paid advertiser.

Calls to a specific treatment center’s listing will be connected directly to that center.

Calls to our general helpline will be answered by treatment providers, all of whom are paid advertisers.

By calling the helpline, you agree to our terms and conditions. These calls are free of charge and carry no obligation to enter treatment. Neither Sober Steps nor anyone answering your call receives a commission or fee based on your choice of treatment provider.

If you’d like to explore additional treatment options or connect with a specific rehab center, you can browse our top-rated listings, visit our homepage, or call us at (844) 491-5566. You may also contact us for further assistance.