Beacon Health Insurance Coverage for Drug Rehab: Key Insights

Navigate your Beacon Health Insurance Coverage for Drug Rehab. Verify benefits, understand costs, and find treatment options now.

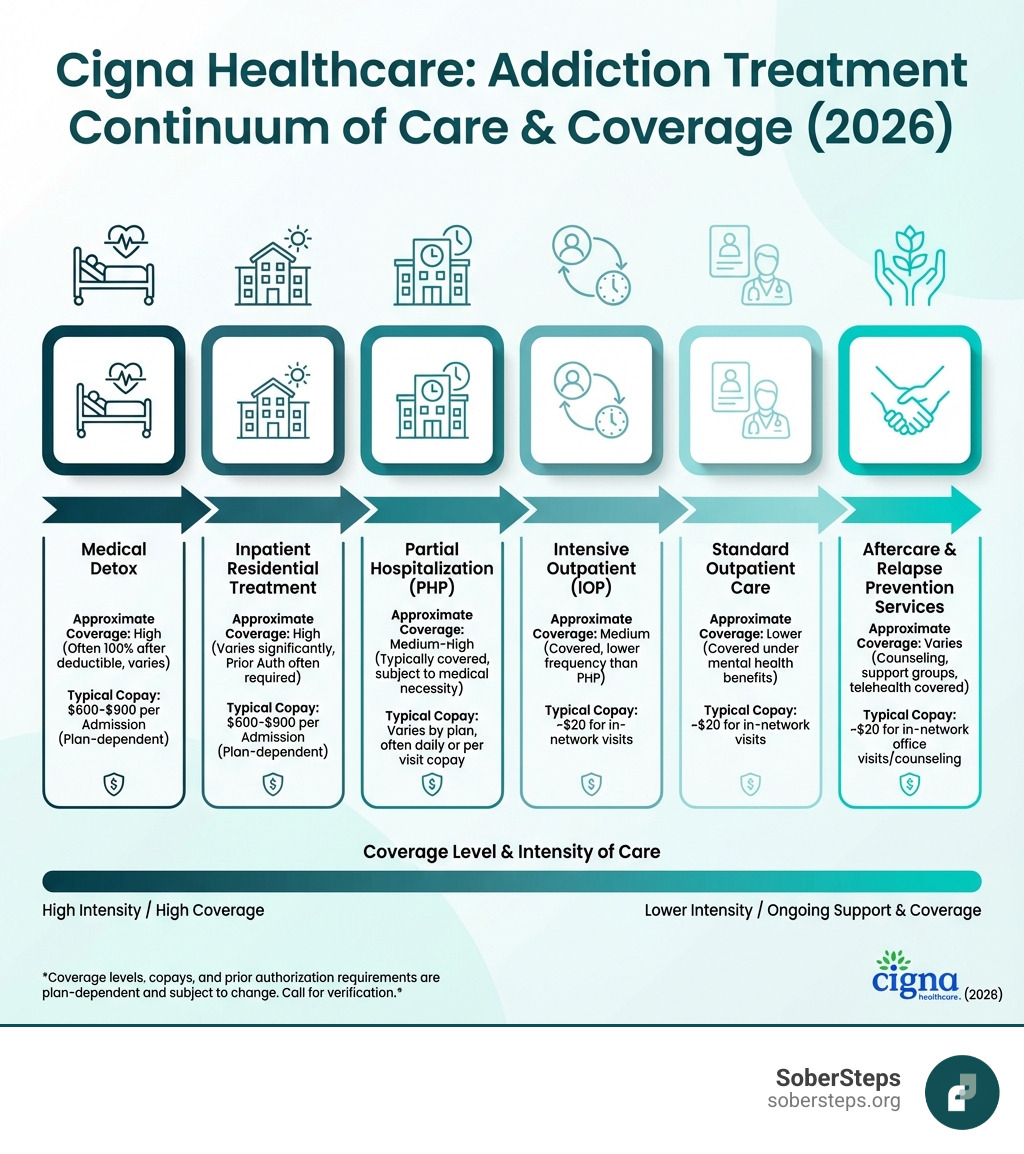

Cigna Healthcare: Addiction Treatment & Rehab Coverage (2026) provides comprehensive benefits for substance use disorder treatment under federal mental health parity laws. If you’re a Cigna member seeking addiction treatment, here’s what you need to know right now:

Quick Coverage Overview:

For immediate, confidential verification of your benefits, call (844) 491-5566.

The addiction crisis continues to devastate families across America. Overdose deaths increased 28.5% in the 12 months ending April 2021, with more than 100,000 people dying from opioids alone in a single year. Understanding your insurance coverage shouldn’t add to that burden.

Cigna serves over 180 million customers globally and provides addiction treatment coverage through behavioral health benefits administered by Evernorth Behavioral Health, Inc. Under the Mental Health Parity and Addiction Equity Act (MHPAEA), Cigna must cover substance use disorder treatment at the same level as physical health conditions.

The reality is simple: coverage exists, but navigating it feels overwhelming. Different plan types (HMO, PPO, EPO), varying deductibles, confusing prior authorization requirements, and questions about which facilities are “in-network” create barriers when you’re already struggling.

You don’t have to figure this out alone. Call (844) 491-5566 for free, confidential insurance verification and help finding appropriate treatment.

At Sober Steps, we’ve helped thousands of individuals understand their Cigna Healthcare: Addiction Treatment & Rehab Coverage (2026) and connect with quality treatment providers. Our mission is to remove the confusion and barriers that stand between you and recovery, providing confidential guidance every step of the way.

When you’re facing addiction, the last thing you need is a labyrinth of insurance jargon. Thankfully, Cigna has a strong commitment to behavioral health, recognizing that mental well-being is as crucial as physical health. This commitment is underpinned by their Behavioral Health Division and the administration of behavioral health benefits by Evernorth Behavioral Health, Inc. This specialized division works to support individuals facing drug or alcohol addiction, offering mental health care and educational resources.

Cigna’s coverage for addiction treatment, like any medical service, hinges on what they define as “medical necessity.” This isn’t just a fancy term; it means that the treatment must align with generally accepted standards of medical practice, be clinically appropriate, effective for your condition, and not primarily for convenience or more costly than an equivalent alternative. Essentially, it needs to be the right care, at the right time, in the right setting.

Cigna Healthcare: Addiction Treatment & Rehab Coverage (2026) typically includes both inpatient and outpatient addiction treatment. Whether you need 24/7 care in a residential facility (inpatient) or prefer to live at home while attending scheduled therapy and support (outpatient) depends on your individual needs and medical necessity.

For immediate, confidential help with understanding Cigna’s medical necessity criteria and how it applies to your situation, call (844) 491-5566.

Cigna provides comprehensive coverage for a wide array of addiction treatment services, all designed to support your journey to sobriety. This extensive coverage is mandated by laws like the Affordable Care Act (ACA), which requires insurance companies to provide coverage for mental health treatment, including substance use disorder (SUD). Cigna’s network includes a wide range of rehab centers, from standard inpatient programs to outpatient clinics and holistic treatment centers.

Here’s a breakdown of the types of addiction treatment services Cigna typically covers:

For more detailed information about Cigna’s substance use disorder treatment coverage, you can visit their official page: More on Cigna’s SUD treatment options.

Absolutely! Cigna Healthcare: Addiction Treatment & Rehab Coverage (2026) explicitly includes treatment for co-occurring mental health and substance use disorders, often referred to as “dual diagnosis.” This is a crucial aspect of modern addiction treatment, as many individuals battling substance abuse also struggle with underlying mental health conditions like depression, anxiety, PTSD, or bipolar disorder.

Cigna’s core principles emphasize that effective treatment must address both mental and physical health together. They recognize that an integrated treatment approach is essential for lasting recovery. This means that if you’re dealing with both a substance use disorder and a mental health condition, Cigna plans are designed to cover treatment that addresses both simultaneously. This integrated care is often more effective than treating each condition separately, as they often influence and exacerbate each other.

The Affordable Care Act (ACA) requires insurance companies to provide some coverage for mental health treatment, including treating substance use disorder (SUD). This legal framework, combined with Cigna’s own commitment to holistic health, ensures that members have access to comprehensive care for co-occurring disorders. Our team understands the complexities of dual diagnosis and can help you verify your benefits for this specialized care.

You can find more information about Cigna’s mental health benefits, which encompass dual diagnosis treatment, here: Cigna’s mental health benefits.

_compressed.webp?alt=media&token=5ccac06b-6783-4a36-b04f-44434488e6b2)

Understanding your Cigna plan is like learning the secret handshake to open uping your benefits. It’s not just about what Cigna covers, but how much you’ll pay out-of-pocket. This includes understanding deductibles, copayments, coinsurance, and out-of-pocket maximums.

Understanding your plan is the first step towards taking control of your health and recovery. For a free, confidential verification of your specific plan details, call (844) 491-5566.

Cigna offers different types of health insurance plans, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Exclusive Provider Organization (EPO), Point-of-Service (POS), and Medicare Advantage. Within these, plans are often categorized into tiers: Bronze, Silver, Gold, and Platinum. These tiers significantly impact your Cigna Healthcare: Addiction Treatment & Rehab Coverage (2026) and your out-of-pocket costs.

Here’s a general overview of how plan tiers affect coverage:

| Plan Tier | Premiums | Deductibles | Coinsurance (In-Network) | Out-of-Pocket Costs | Typical Coverage for Addiction Treatment |

|---|---|---|---|---|---|

| Bronze | Lowest | Highest | 0% – 40% after deductible | Highest | Lower monthly cost, but you pay more when you use services. Might have a $3,000 copay for the first three days of inpatient treatment. |

| Silver | Moderate | Moderate | 30% – 50% after deductible | Moderate | A good balance between monthly premiums and out-of-pocket costs. Might have a $2,500 copay for the first three days of inpatient treatment. |

| Gold | High | Low | 20% – 50% after deductible | Low | Higher monthly cost, but you pay less when you use services. Could have a $20 copay for office visits with no deductible and 20% coinsurance for inpatient treatment. |

| Platinum | Highest | Lowest | 10% – 30% after deductible | Lowest | The highest monthly cost, but minimal out-of-pocket expenses for covered services. |

Note: These are general examples. Your specific plan details (including exact percentages and dollar amounts) will vary based on your state, employer, and the specific plan you choose. Always review your Summary of Benefits and Coverage (SBC).

For more information on these plan types, Cigna provides resources on the Types of health insurance plans.

When it comes to addiction treatment, deciding between in-network and out-of-network providers can have a significant impact on your wallet. Cigna’s policy generally favors in-network facilities.

Navigating your insurance benefits for addiction treatment can feel like a daunting task, but it doesn’t have to be. Verifying your Cigna benefits is a crucial step that empowers you to understand your coverage, anticipate costs, and make informed decisions about your treatment. It helps prevent unexpected bills and ensures you get the most out of your Cigna Healthcare: Addiction Treatment & Rehab Coverage (2026).

The importance of verification cannot be overstated. Before beginning any treatment, we always recommend confirming your coverage directly with Cigna. This simple step can save you a lot of stress and financial burden down the line. Don’t steer this alone; get confidential help by calling (844) 491-5566 today.

Verifying your Cigna insurance benefits for rehab is a straightforward process when you know the steps:

Preauthorization Requirements: Does Cigna require preauthorization for addiction treatment services? Yes, often they do. For inpatient/residential treatment and sometimes for specific outpatient programs or out-of-network services, Cigna will require preauthorization. This is a process where the treatment provider submits a request to Cigna for approval before services begin. Cigna reviews this request against their medical necessity criteria. Without preauthorization, Cigna may deny coverage for the services, leaving you responsible for the full cost.

Information Needed for Verification: When you call Cigna or provide information to a treatment center for verification, have the following ready:

Once you understand your benefits, the next step is finding a treatment center that accepts your Cigna plan and provides the care you need. Opting for an in-network facility is almost always the financially smarter choice.

Our team can help you find a Cigna-approved center that fits your needs and budget. Call (844) 491-5566 for a confidential assessment and assistance in finding the right in-network facility.

We know you have questions, and we’re here to provide clear, straightforward answers.

The very first step to getting addiction treatment covered by Cigna is typically a clinical assessment to determine medical necessity. This assessment evaluates the severity of your substance use disorder, any co-occurring mental health conditions, and your overall physical health to recommend the most appropriate level of care. This can be done by your primary care physician, a mental health professional, or the admissions team at a treatment facility. Based on this assessment, Cigna will then require preauthorization for certain levels of care, especially for inpatient or residential rehab. This preauthorization process ensures that the recommended treatment aligns with Cigna’s medical necessity criteria.

Yes, there can be limits on the duration of treatment that Cigna will cover. These limits are primarily based on two factors: medical necessity and the specifics of your individual plan. For example, some Cigna plans might cover up to 20 inpatient days per calendar year for mental health and substance abuse services when using out-of-network providers. For in-network care, coverage can be more extensive but is still contingent on ongoing medical necessity reviews. This means that for continued stays, the treatment facility will need to periodically provide documentation to Cigna demonstrating that the treatment remains medically necessary and that you are making progress, or that a lower level of care is not yet appropriate. Always check your specific plan documents for exact duration limits.

If Cigna denies coverage for your addiction treatment, it can be disheartening, but you have rights. You have the right to an appeal. The process typically involves:

It’s crucial not to give up if coverage is initially denied. Persistence and proper documentation, often with the help of your treatment provider, can lead to a successful appeal.

Navigating Cigna Healthcare: Addiction Treatment & Rehab Coverage (2026) doesn’t have to be a journey you start on alone. The Affordable Care Act (ACA) ensures that mental health and substance use disorder treatment are considered essential health benefits, meaning your Cigna plan is designed to provide coverage. However, understanding the nuances of your specific plan—from deductibles and copays to preauthorization and in-network providers—is vital for a smooth and stress-free path to recovery.

At SoberSteps, we understand the courage it takes to seek help. Our mission is to provide confidential and anonymous assistance, helping you cut through the complexities of insurance coverage and connect with the right treatment. We believe that everyone deserves a chance at a healthier, sober life, and financial barriers shouldn’t stand in the way.

Take control of your life today by calling (844) 491-5566 for a no-obligation consultation. We’re here to help you understand your Cigna Healthcare: Addiction Treatment & Rehab Coverage (2026) and guide you towards effective treatment options. Don’t let confusion delay your recovery—let us help you take that crucial next step.

Navigate your Beacon Health Insurance Coverage for Drug Rehab. Verify benefits, understand costs, and find treatment options now.

Navigate Drug Withdrawal safely. Understand symptoms, timelines, and get expert help for a healthier future. Call us!

Ready to get help addiction? Find signs, treatment options, and support with SoberSteps. Start your confidential recovery journey today.

For anyone seeking help for addiction for themselves or a loved one calls to Sober Steps are completely confidential and available 24/7.

Please note: any treatment center listed on our site that receives calls is a paid advertiser.

Calls to a specific treatment center’s listing will be connected directly to that center.

Calls to our general helpline will be answered by treatment providers, all of whom are paid advertisers.

By calling the helpline, you agree to our terms and conditions. These calls are free of charge and carry no obligation to enter treatment. Neither Sober Steps nor anyone answering your call receives a commission or fee based on your choice of treatment provider.

If you’d like to explore additional treatment options or connect with a specific rehab center, you can browse our top-rated listings, visit our homepage, or call us at (844) 491-5566. You may also contact us for further assistance.