Understanding Your Mental Health Insurance Benefits

Mental health insurance is coverage in your health plan that pays for mental health and substance use disorder treatment. Here’s what you need to know:

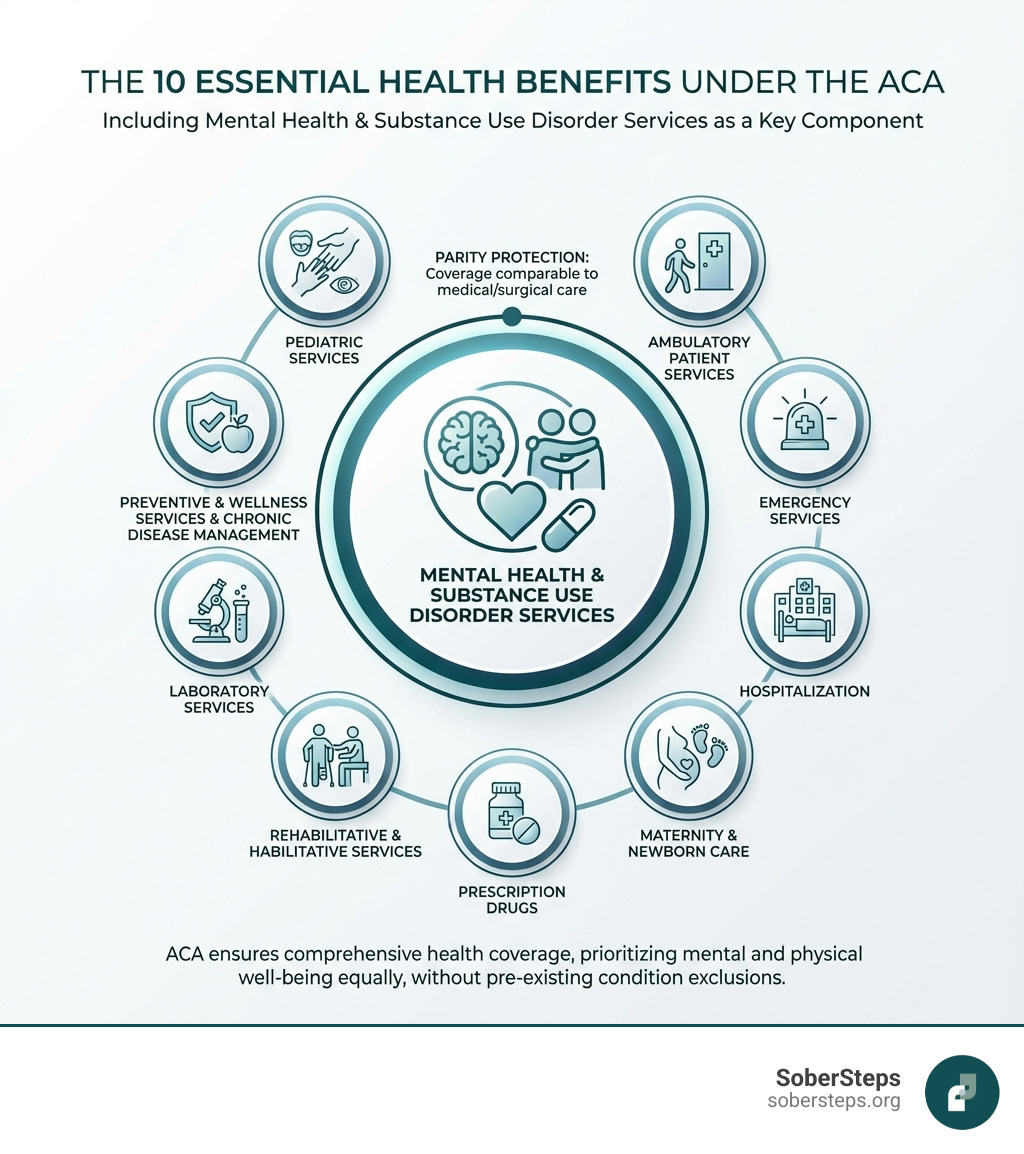

- Coverage is legally required – Most plans must cover mental health services as an essential health benefit under the Affordable Care Act (ACA)

- Equal to physical health – The Mental Health Parity Act requires insurers to cover mental health treatment with the same limits and costs as medical care

- Pre-existing conditions protected – Since 2014, insurers cannot deny you coverage or charge more due to pre-existing mental health conditions

- Common services covered – Therapy, counseling, inpatient treatment, outpatient care, and prescription medications for mental health conditions

- Multiple plan types – Coverage is available through employer plans, Marketplace plans, Medicare, and Medicaid

Mental health is as important as physical health, but insurers haven’t always agreed. For decades, many plans provided better coverage for physical illness than for mental health disorders. For instance, you might have paid a $20 copay for a primary care visit but $50 for a therapist, or your plan might have capped therapy sessions while allowing unlimited doctor visits.

That changed with two landmark pieces of legislation. The Mental Health Parity and Addiction Equity Act of 2008 required equal treatment. The Affordable Care Act of 2010 went further by mandating that most plans include mental health coverage as one of ten essential health benefits. Together, these laws extended mental health and substance use disorder benefits to an estimated 62 million Americans.

But here’s the problem: a 2014 survey found that more than 90 percent of Americans were unfamiliar with the mental health parity law. Many people still don’t know what their insurance covers or how to use it. They might need help but don’t seek it because they assume it’s not covered or too expensive.

If you’re struggling with mental health or substance use issues, understanding your insurance coverage is a critical first step toward getting help. You may have more benefits than you realize. This guide will walk you through what mental health insurance covers, how the laws protect you, and how to use your benefits.

At Sober Steps, we’ve dedicated ourselves to helping individuals steer the complexities of mental health and addiction treatment, including understanding mental health insurance coverage options. We know that finding confidential, effective care starts with knowing what resources are available to you.

For confidential help with mental health or substance use, call our 24/7 helpline at (844) 491-5566.

The Legal Foundation: How Laws Mandate Mental Health Coverage

Before recent laws, navigating mental health insurance was a maze. Insurers often treated mental health conditions differently than physical ones, with stricter limits and higher costs. Thanks to two pivotal laws, the landscape has improved, and mental health is now recognized as integral to overall health.

What is the Mental Health Parity and Addiction Equity Act (MHPAEA)?

The Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act (MHPAEA), often called the federal parity law, was enacted in 2008. Its core principle is simple: if a health plan offers coverage for mental health and substance use disorder services, it must do so in a way that is comparable to its coverage for medical and surgical care.

This means financial requirements—like copayments, deductibles, and out-of-pocket maximums—cannot be more restrictive for mental health services than for physical health services. For example, if your copay for a doctor’s visit is $20, your copay for a therapy session should not be $40. Similarly, treatment limitations, such as the number of days you can stay in a hospital, must also be equal. The parity law prevents insurers from putting a firm annual limit on the number of covered mental health sessions, a common practice in the past.

The federal parity law requires insurance companies to treat mental and behavioral health and substance use disorder coverage equal to (or better than) medical/surgical coverage. While the law doesn’t force plans to offer mental health benefits, if they do, they must comply with these parity requirements.

How the Affordable Care Act (ACA) Expanded Coverage

Building on MHPAEA, the Affordable Care Act (ACA) of 2010 brought about one of the largest expansions of mental health and substance use disorder coverage in a generation. The ACA didn’t just mandate parity; it mandated inclusion.

Under the ACA, most individual and small group health insurance plans, including all plans on the Health Insurance Marketplace, must cover mental health and substance use disorder services as one of the ten essential health benefits. This means these services are a fundamental part of your health coverage.

A significant benefit of the ACA is its stance on pre-existing conditions. Since 2014, most plans cannot deny you coverage or charge you more for pre-existing health conditions, including mental illnesses. This was a game-changer for countless individuals who struggled to find affordable coverage due to a history of depression, anxiety, or other mental health challenges.

Furthermore, the ACA requires most health plans to cover preventive services, like depression screening for adults and behavioral assessments for children, at no additional cost. This focus on early detection can make a huge difference in managing mental health proactively. The ACA also implemented a dramatic Medicaid expansion in some states, extending benefits to approximately 1.6 million Americans with diagnosed substance use disorders (SUDs) who previously lacked access to treatment.

To learn more about the ACA’s impact on mental health coverage, we recommend exploring resources like The ACA’s impact on mental health coverage.

For confidential help with mental health or substance use, call our 24/7 helpline at (844) 491-5566.

Decoding Your Benefits: What Mental Health Insurance Typically Covers

So, what does mental health insurance cover? While specifics vary by plan, the federal parity law and the ACA established a broad range of typically included services. If a service is essential for physical health, a comparable mental health service should also be covered.

Common Mental Health Conditions Covered

Thanks to the ACA and parity laws, insurance plans generally cover a wide array of mental health conditions. While a plan can exclude certain diagnoses, these exclusions must be clearly stated and apply equally to physical health conditions. Most common conditions we see covered include:

- Anxiety Disorders (Generalized Anxiety Disorder, Panic Disorder, Social Anxiety)

- Depression (Major Depressive Disorder, Persistent Depressive Disorder)

- Bipolar Disorder

- Post-Traumatic Stress Disorder (PTSD)

- Obsessive-Compulsive Disorder (OCD)

- Eating Disorders (Anorexia Nervosa, Bulimia Nervosa, Binge Eating Disorder)

- Substance Use Disorders (SUD)

- Grief and adjustment difficulties

- Stress management issues

Understanding Levels of Care

Just like physical health, mental health treatment isn’t one-size-fits-all. Insurance plans typically cover a spectrum of care, from crisis intervention to ongoing maintenance. Understanding these levels can help you and your provider determine the most appropriate path for your recovery:

- Medical detox: For individuals needing medically supervised withdrawal from substances.

- Inpatient hospitalization: For acute mental health crises or severe substance withdrawal, requiring 24/7 medical and psychiatric care in a hospital setting.

- Residential treatment: A live-in program offering structured therapy and support for individuals needing intensive, long-term care outside a hospital.

- Partial Hospitalization Programs (PHP): Often called “day treatment,” these programs provide intensive therapy and medical monitoring for several hours a day, several days a week, allowing clients to return home at night.

- Intensive Outpatient Programs (IOP): Less intensive than PHP, IOPs offer structured therapy and support for a few hours a day, a few days a week, providing flexibility for work or school.

- Outpatient therapy: Regular sessions with a therapist, psychologist, or counselor, often on a weekly or bi-weekly basis. This includes individual, group, and family therapy.

- Medication management: Appointments with a psychiatrist or other prescribing medical professional to evaluate, prescribe, and monitor psychiatric medications.

- Prescription drugs: Medications for mental health conditions are typically covered under your plan’s prescription drug benefits (often Medicare Part D for Medicare beneficiaries).

- Emergency mental health services: Crisis intervention and stabilization services for immediate, severe mental health needs.

For confidential help with mental health or substance use, call our 24/7 helpline at (844) 491-5566.

A Guide to Different Plan Types: Medicare, Medicaid, and Private Insurance

The world of health insurance is complex, with many plan types. Each has its own rules, but the principles of mental health parity and essential benefits generally apply across the U.S. Let’s break down the main plan types and their mental health coverage.

Private Mental Health Insurance Plans

Private insurance is often obtained through an employer or purchased directly through the Health Insurance Marketplace. These plans can be categorized by how they manage your care and provider choices:

- Employer-sponsored coverage: Many Americans receive their health insurance through their job. These plans are generally subject to MHPAEA, meaning your mental health benefits should be comparable to your physical health benefits.

- Individual plans (Marketplace): If you don’t get insurance through an employer, you can purchase a plan on the Health Insurance Marketplace (healthcare.gov). All plans sold here are required by the ACA to cover mental health and substance use disorder services as essential health benefits.

- In-network vs. out-of-network: Most private plans have a network of preferred providers. Services from in-network providers are typically covered at a higher rate, with lower out-of-pocket costs (deductibles, copays, coinsurance). If your plan covers out-of-network services for physical health, it must do the same for mental health.

- Summary of Benefits and Coverage (SBC): This document, provided by your insurer, outlines your plan’s coverage, costs, and limitations in an easy-to-understand format. It’s an excellent resource for understanding your mental health insurance benefits.

Medicare Coverage for Mental Health

Medicare, our federal health insurance program for people 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease, also covers a range of mental health services.

- Medicare Part A (Hospital Insurance): Covers inpatient mental health care services you get in a hospital, including your room, meals, nursing care, and other related services and supplies. You can find more details on inpatient mental health care under Medicare.

- Medicare Part B (Medical Insurance): Helps cover mental health services you’d typically get outside of a hospital. This includes visits with a psychiatrist or other doctor, clinical psychologists, clinical social workers, and lab tests ordered by your doctor. This also includes services like partial hospitalization. For more information, check out outpatient mental health services under Medicare.

- Medicare Part D (Prescription Drugs): Helps cover drugs you may need to treat a mental health condition. Each Part D plan has its own list of covered drugs (formulary), so it’s important to check which medications are included.

- Medicare Advantage Plans (Part C): These plans are offered by private companies approved by Medicare. They cover all Part A and Part B services and often include Part D. If you have a Medicare Advantage Plan, you’ll need to check your plan’s specific materials for details on mental health coverage, as benefits and costs can vary.

For more detailed information, the official Medicare website offers publications like Medicare and Your Mental Health Benefits.

Medicaid and CHIP Coverage

Medicaid and the Children’s Health Insurance Program (CHIP) provide health coverage to millions of Americans, including low-income adults, children, pregnant women, elderly adults, and people with disabilities.

- Medicaid: All state Medicaid programs provide some mental health services, and most offer substance use disorder services. The scope of coverage can vary by state, but federal law requires children to receive a wide range of medically necessary mental health services. Under the ACA, new Medicaid adult expansion populations must also have coverage for essential health benefits, including mental health and substance use disorder benefits, and meet parity requirements.

- Children’s Health Insurance Program (CHIP): CHIP beneficiaries receive a full array of services, including mental health and substance use disorder treatment. These services are considered medically necessary and are crucial for the development and well-being of children.

The Centers for Medicare & Medicaid Services (CMS) provides more insights into Behavioral Health Services under Medicaid. If you have more questions about coverage, you can also contact your State Health Insurance Assistance Program (SHIP) for assistance.

For confidential help with mental health or substance use, call our 24/7 helpline at (844) 491-5566.

Your Action Plan: How to Verify and Use Your Coverage

Understanding the laws and plan types is one thing, but using your mental health insurance to get care is another. It requires some proactive work, but it’s worth it. Knowing your benefits upfront can save you from unexpected costs and help you access the right care without delay.

How to Check Your Specific Plan’s Benefits

The best way to know what your mental health insurance covers is to go straight to the source: your insurance provider.

- Call your insurance provider: Look for the member services phone number on the back of your insurance card. This is your direct line to a representative who can explain your specific benefits.

- Check plan documents: Your insurer should provide a Summary of Benefits and Coverage (SBC) and other plan documents. These are designed to be clear and concise, outlining what’s covered, what your costs are, and any limitations.

- Use your online member portal: Most insurance companies offer an online portal where you can view your benefits, claims, and sometimes even find in-network providers.

- Ask about in-network providers: Confirm which mental health professionals, facilities, or treatment centers are “in-network” with your plan. This typically ensures the highest level of coverage and lowest out-of-pocket costs.

Questions to Ask Your Insurance Provider

When you call your insurance provider, have a list of questions ready. Here are some key ones we recommend:

- “What are my mental health and substance use disorder benefits?”

- “What is my copay or coinsurance for outpatient therapy sessions (e.g., with a psychologist or clinical social worker)?”

- “What is my copay or coinsurance for psychiatrist visits for medication management?”

- “What is my deductible, and have I met it for the current plan year?”

- “Is pre-authorization required for mental health services, such as inpatient treatment, residential care, or even a certain number of therapy sessions?”

- “Are there any annual limits on the number of therapy sessions or days of inpatient/residential treatment covered?” (Strict numerical limits for mental health should be equal to medical/surgical limits under parity laws, but medical necessity reviews are common.)

- “What is the process for out-of-network reimbursement if I choose a provider not in your network?”

- “Do you cover specific types of therapy like Cognitive Behavioral Therapy (CBT) or Dialectical Behavior Therapy (DBT)?”

- “Are there specific facilities or programs for substance use disorder treatment that are covered?”

For confidential help with mental health or substance use, call our 24/7 helpline at (844) 491-5566.

Navigating Challenges: Denials, Parity Violations, and Pre-Existing Conditions

Even with laws in place, navigating mental health insurance can be an uphill battle. You might face denials or suspect your plan isn’t meeting parity requirements. Don’t lose hope. We’re here to help you understand your rights and the steps you can take.

What to Do if Your Mental Health Insurance Claim is Denied

Receiving a denial letter can be frustrating, but it’s not always the final answer. Here’s our action plan:

- Review the denial letter carefully: It must explain why your claim was denied and how to appeal. Understand the specific reason for the denial (e.g., not medically necessary, out-of-network, missing information).

- Gather documentation: Collect all relevant medical records, treatment plans, and communication with your provider that support the medical necessity of the service.

- File an internal appeal: Your denial letter will outline the process for an internal appeal with your insurance company. Submit your appeal in writing, include all supporting documents, and keep copies for your records. Clearly explain why you believe the service should be covered.

- Seek an external review: If your internal appeal is denied, you typically have the right to an external review. An independent third party will review your case. Your state’s Department of Insurance or a similar regulatory body usually manages this process.

- Contact your State Insurance Commissioner: For persistent issues or if you feel unfairly treated, your state’s insurance department can provide assistance and investigate complaints.

Steps to Take for a Suspected Parity Violation

If you believe your mental health insurance plan is not complying with the federal parity law – for instance, by imposing stricter limits or higher costs for mental health care compared to physical health care – it’s crucial to act.

- Document everything: Keep detailed records of all communication with your insurance company, including dates, names of representatives, and summaries of conversations. Save all denial letters and plan documents.

- Compare mental health vs. medical costs/limits: Review your plan’s Summary of Benefits and Coverage (SBC) to identify any disparities. For example, if your plan has a 20-session limit for mental health therapy but no comparable limit for physical therapy, that could be a violation. If your copay for a psychologist is $20, but only $10 for a primary care physician, it might be permissible if $20 is consistent with or less than copays for the majority of medical services. However, if the copay for mental health is disproportionately higher than most medical services, it’s a red flag.

- Contact your HR department (if applicable): If you have employer-sponsored insurance, your HR department can be a valuable resource. They can help you understand your benefits and may be able to intervene with the insurance company.

- File a complaint: You can file a complaint with:

- Your state’s Department of Insurance.

- The U.S. Department of Labor’s Employee Benefits Security Administration (EBSA) if your plan is an employer-sponsored plan. You can call their consumer assistance line at (866) 444-3272.

- The U.S. Department of Health and Human Services (HHS) offers resources for parity complaints.

- You may also visit the Parity Track website for information about mental health parity or links to state agencies, as well as other valuable resources. This website offers you the chance to submit a complaint with them about your experience. Registering a complaint with Parity Track is not a substitute for filing an appeal or complaint with a governmental agency.

- Use Consumer Assistance Programs: The federal government’s Consumer Assistance Program can also provide guidance and support.

Can an insurance plan refuse to cover my pre-existing mental health condition?

No, under the Affordable Care Act (ACA), most individual and small employer health insurance plans cannot deny you coverage or charge you more due to pre-existing health conditions, including mental illnesses. This was a monumental shift that ensures individuals with a history of mental health challenges can access the care they need without discrimination. This protection applies to plans purchased through the Health Insurance Marketplace and most employer-sponsored plans.

For confidential help with mental health or substance use, call our 24/7 helpline at (844) 491-5566.

Frequently Asked Questions about Mental Health Coverage

It’s normal to have more questions. Here are answers to common inquiries we receive about mental health insurance.

Can an insurance plan refuse to cover my pre-existing mental health condition?

Absolutely not, for most health insurance plans in the United States. The Affordable Care Act (ACA), fully implemented by 2014, made it illegal for most health plans to deny coverage or charge you more due to pre-existing conditions, including mental illnesses. This means if you had depression, anxiety, or a substance use disorder before your current insurance started, your plan cannot exclude coverage for that condition. This applies to individual plans purchased on the Marketplace and most employer-sponsored plans.

Is there a limit on how many therapy sessions my insurance will cover?

Under the federal Mental Health Parity and Addiction Equity Act (MHPAEA), your plan cannot apply a strict numerical limit (e.g., “only 20 therapy sessions per year”) to mental health benefits if they don’t apply a comparable limit to medical or surgical benefits. In the past, annual session limits were common, but the parity law largely prevents insurers from putting a firm annual limit on the number of mental health sessions that are covered.

However, insurers can still manage care based on “medical necessity.” This means they might require pre-authorization after a certain number of sessions or an evaluation to determine if continued treatment is medically necessary. This process should be the same as what they would require for a physical health condition. If your plan terminates or reduces care prematurely based on their criteria, it could be a violation of parity.

Why won’t some therapists accept insurance?

This is a common and often frustrating issue for individuals seeking mental health care. While you might have excellent mental health insurance, many therapists choose not to be in-network with insurance companies for several reasons:

- Low reimbursement rates: Historically, and even currently, reimbursement rates from insurance companies for mental health services have not kept pace with the cost of running a practice. Some rates have even decreased over time, making it financially challenging for therapists to accept insurance.

- Administrative burden: Dealing with insurance companies involves significant paperwork, pre-authorizations, billing, and appeals, which can be time-consuming and detract from a therapist’s ability to focus on patient care.

- Privacy concerns: Some therapists and clients prefer to avoid insurance involvement to maintain a higher level of privacy regarding diagnoses and treatment plans, as insurance companies often require access to this information for billing and medical necessity reviews.

- Flexibility in treatment: Being out-of-network allows therapists more freedom to tailor treatment plans to individual needs without being constrained by insurance company guidelines or session limits.

If your preferred therapist doesn’t accept your insurance, you might still have options. If your plan offers out-of-network benefits, you could pay the therapist directly and then submit a claim to your insurance company for partial reimbursement. It’s always best to discuss this with both your therapist and your insurance provider beforehand.

For confidential help with mental health or substance use, call our 24/7 helpline at (844) 491-5566.

Conclusion

Navigating mental health insurance can feel overwhelming, but we hope this guide has empowered you to seek the care you deserve. Mental health is health. Thanks to laws like the Mental Health Parity and Addiction Equity Act and the Affordable Care Act, your insurance is legally obligated to treat it as such.

We’ve reviewed how most plans must cover mental health services, that coverage should be comparable to physical health, and that pre-existing conditions are protected. We’ve explored the services covered, levels of care, and how coverage varies across plans. Most importantly, we’ve provided an action plan to verify your benefits, ask the right questions, and handle challenges like denials.

Seeking help for mental health or substance use issues is a sign of incredible strength, not weakness. Our goal at SoberSteps is to ensure that financial barriers don’t stand in the way of your recovery journey.

If you or a loved one are seeking confidential and anonymous help for mental health needs or substance use disorders, we are here to support you every step of the way. Visit Find confidential and anonymous help for your mental health needs to learn more. For immediate assistance, please don’t hesitate to call our 24/7 helpline at (844) 491-5566.